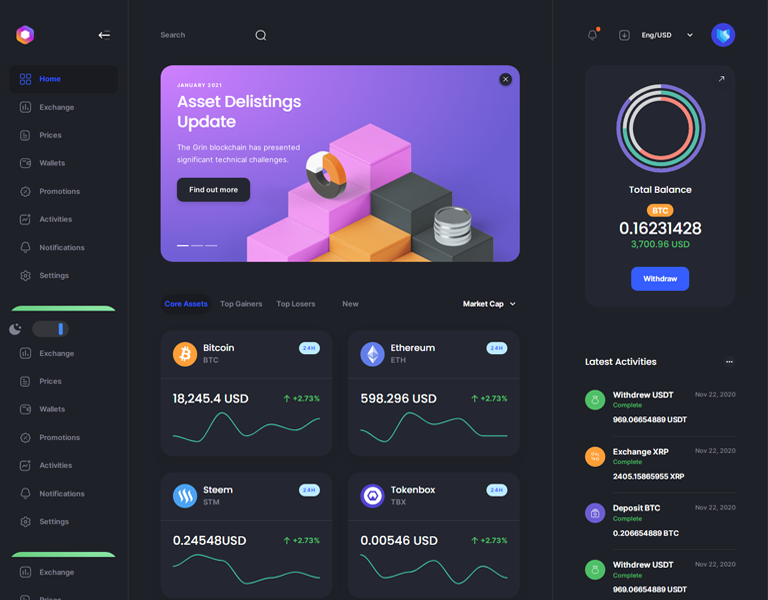

Crypto Trading With Lowest Commission

Empowering Businesses with Blockchain Solutions

Arbitronix.io is a leading platform specializing in blockchain solutions and decentralized technologies. Our mission is to empower businesses and individuals with innovative tools and services that leverage the power of blockchain for secure, transparent, and efficient operations.